Is Reflexer/Rai a stablecoin?

What is Rai?

Reflexer Labs (the folks who are behind Rai) describe Rai as a “decentralized and non-pegged stablecoin that defies fiat currencies”. This seems counter-intuitive for most definitions of stablecoins, as they are nearly always pegged to a fiat currency. This is true for “money market” style coins like Tether, over-collateralized coins such as Dai, and algorithmic stablecoins like Terra. However, Rai does not try to maintain a tight peg to a specific currency, instead allowing itself to drift based on demand, while trying to make sure that drift is never too aggressive. It is a very different conception of stablecoin, but does remind me of the Target Rate Feedback Mechanism that was originally part of Dai, which makes sense because Rai is a fork of Dai.

How does it work?

Ether is deposited into a ‘’SAFE” (equivalent to MakerDAO ‘Collateralized Debt Position’) with the loan extended and the debt denominated in Rai. Simply, Rai is overcollateralized by Ether and the protocol will attempt to liquidate the positions if necessary to keep the system collateralized. If the system is unable to liquidate the position in time then the surplus in the protocol is used first, and if that is insufficient the protocol attempts to sell more of it’s governance token (FLX) to cover the deficit. The surplus is funded by the borrow rate paid when Rai is created.

These liquidation mechanisms are of course not without their own risks, including chain congestion which contributed to MakerDAO’s ‘Black Thursday’ where users were unable to get bids in due to change congestion and default configurations which were not well suited to a congested chain.

The protocol has two prices for Rai that it tracks, the ‘market price’ and the ‘redemption price’. The redemption price is what the protocol currently ‘wants’ the value of Rai to be, and the market price is the price on Uniswap.

When the value of the redemption price and the market price differ, the protocol begins to change the redemption price to correct for the imbalance. If the market price begins to fall, the redemption price (perhaps counter-intuitively) will rise. The intention behind raising the redemption price is to make it so that less Rai can be borrowed against Ether, potentially motivating people to modify their positions (and hopefully purchase Rai to do so).

The additional brinksmanship at play here is the ‘global settlement’ option. Global settlement is effectively pressing the big red button and returning collateral. Collateral is distributed based on the redemption price, so people who purchased Rai at a market price below the redemption price get a disproportionate share of the collateral. This is meant to help incentive users who create the Rai to purchase Rai and close their positions, so that they are not exposed to that risk.

What does it mean to be stable?

Reflexer wants us to think stable means less volatile than the collateralizing asset, and I think that is certainly a definition. However, for a variety of preference and practical reasons, people like to keep things closely tied to the currencies they currently use.

Is Rai a stablecoin?

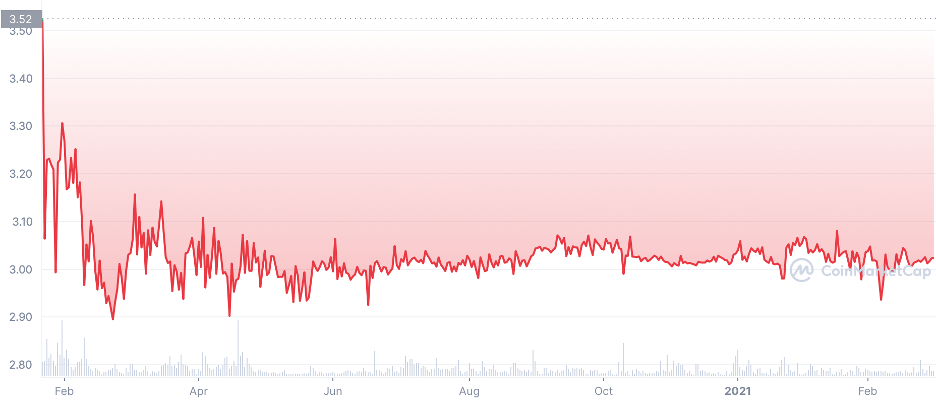

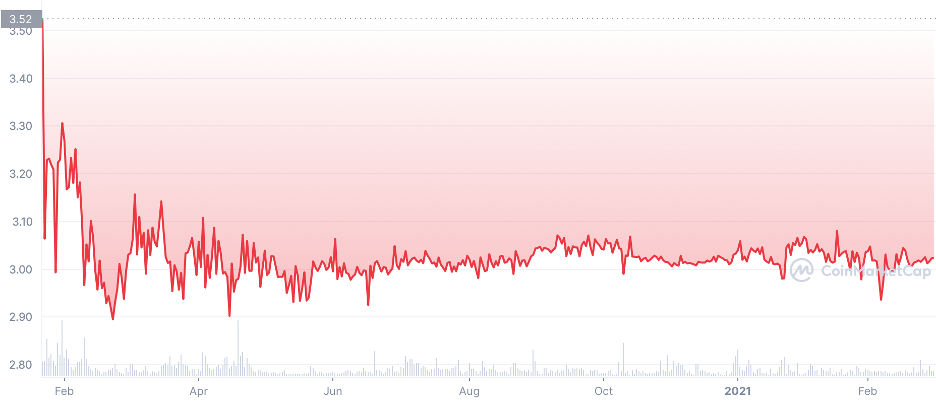

So to answer the titular question, yes I think it is entirely fair for Rai to be called a stablecoin. Tying the definition of stable solely to hard-pegs to existing assets seems…myopic. Especially since Rai has been pretty stable:

Furthermore, Rai claims to have broken the connection to fiat currencies, but this is a fib. The ‘redemption price’ and the ‘market price’ are both meant to stay relatively ‘stable’ and are of course denominated in dollars. Rai DOES drift, but is designed to stick pretty close to a dollar (or actually $3). The design allows for this index to be changed to a non-dollar asset, and it could even be replaced with a basket of assets, but the design still ‘pegs’ to something and the most likely candidate for now is the mighty dollar.

Why is Rai so fascinating to me?

Rai is fascinating to me, because it seems to do so many things right.

Censorship-resistant collateral

Other stablecoins like Dai rely on collateral like USDC to help aid in keeping the peg. The problem with this is that the central issuer can at any time freeze the assets and make them worthless. Even worse MakerDAO decided to make these vaults impossible to liquidate, so even if the assets are not frozen, but instead break peg the vaults will not liquidate. It is unlikely that Circle would choose to do this of their own volition, but it is possible that governments could pressure Circle to do this.

Rai only uses Ether as collateral, and Ether is a much harder asset to freeze than USDC.

Avoids brittleness

When Compound initially came on to the market the Dai peg broke for an extended period of time, because people could now easily lend their Dai. In response a new module called the ‘Peg Stability Module’ was deployed. This module allowed USDC to be exchanged ~1:1 for Dai. From this moment onward Dai became much more brittle, as the community decided to sacrifice their censorship-resistance so that it could remain tightly pegged to the dollar.

By sacrificing the tight peg, and allowing the price to react to the ‘demand’ signal (the market price) you allow the system to more gracefully react to adverse market conditions.

Fundamentally, this is the sort of design consideration that I wish was more common in Decentralized Finance. The fundamental value drivers of DeFi are censorship-resistance, resiliency, and to a lesser extent modularity. Protocols should lean into the resilience and make design decisions that widen the range of conditions they can operate in, and often in doing so, you also enable more graceful failure states.

Un-governance

The Rai community is working towards a version of their coin where there would be very little ‘governance’ of the protocol.

Most decentralized finance protocols recognize that they are likely going to need to make changes, especially early in the protocol’s life, but they also recognize that is legally and politically important for it to seem as though these changes are being driven by the community. In order to satisfy this condition they will create smart contracts that they will refer to as Decentralized Autonomous Organizations where token holders can use their tokens to express their opinions on various proposals that are put forward.

The vast majority of these are not meaningfully decentralized, are even less autonomous, and based on their public discourse not even organized. But, out of a feeling of necessity, and perhaps a groping towards the cypherpunk ideals, they continue to exist. However, if we truly want the cryptocurrency protocol to approach some platonic ideal of censorship-resistance, resiliency, decentralization, and immutability, the end-state should be a protocol that has the absolute minimum amount of governance. This is especially true for a protocol that is producing something that other protocols are likely going to depend on.

This is the philosophy of Rai/Reflexer Labs who have laid out a plan they intend to follow to minimize the amount of governance required for the protocol. The plan is thoughtful, laying out the parameters that are currently under governance control and how those could be changed to remove the need for governance. I have not been able to find a similar protocol that has laid out a similarly detailed plan to remove their governance. A few have been launched without any governance, but I cannot find a similar project that has started with it and worked to remove it.

This is so refreshingly different from MakerDAO who are increasingly tying themselves deeper into the existing financial system and with ever more baroque legal structures to allow their machinations to function. Yet, despite this, Rai’s market-cap is less than 1% of Dai’s.

What are stablecoins used for?

Despite Rai’s focus on the things that one FUDder thinks are important, it has seen comparatively little adoption. I believe this is because it is poorly suited for most things that stablecoins are used for.

What drives stablecoin usage?

Stablecoins are often used as the method of transferring funds for trading and arbitrage. Having a tokenized unit of account that can move very quickly between different desks and exchanges is beneficial for traders who are trading across a variety of venues. This utility has been one of the most significant drivers of adoption for ‘centralized’ stablecoins like Tether.

The growth of more decentralized stablecoins has been driven by somewhat different factors. Stablecoins like Dai really exploded once Compound allowed it to be easily lent. In addition, for decentralized finance protocols Dai is a more credibly censorship resistance stablecoin than something like USDC. This is somewhat attenuated by the fact that Circle could likely depeg Dai if they wanted to, but that power is attenuated by the fact that Circle would almost certainly see a defection from their product if they did so (crypto loves brinksmanship).

Rai has chosen to not directly peg to a common unit of account. This makes it ill-suited to trading and arbitrage, especially since any change in the value of Rai is likely to make the accounting vastly more complex.

Rai struggles to complete with Dai, because Dai has made it much cheaper to mint new Dai. You can exchange ~$1USDC for a single Dai through the ironically named ‘Peg Stability Module’, whereas the only way to mint Rai is to significantly over-collateralize it with Ether. Since Dai is generally accepted as ‘censorship-resistant enough’ in DeFi, it makes more sense for many entities to use Dai instead.

Other stablecoins like Terra have recognized that the idea of collateral is for nerds, and the real stablecoins slap on a rudimentary ‘algorithmic’ mechanism and just floor it. So they incentivize Anchor to help drive adoption and liquidity, in the hope that they can induce a critical level of demand that will drive stability.

‘Decentralized’ ‘reserve-assets’ like Olympus DAO realized that the mechanism was the whole thing, and that actually doing the stability thing was overrated. Better just to tell people that your mechanism could work as a ‘wealth-generation machine’ ‘at any scale’.

What is valued in crypto?

One of the fundamental tensions in cryptocurrency is between the fundamental value propositions of censorship-resistance, resiliency, and immutability and the speculative activity that drives most ‘activity’ and ‘decisions’ in cryptocurrency. The reason cryptocurrency has value is one of these, and the reason that crypto is ‘valuable’ is the other one of these. Understanding this dichotomy is useful to understanding why it seems as though criticisms around centralization, censorship-resistance, and resiliency will often fall on deaf ears when brought up to those invested in cryptocurrencies.

USDC and Tether are excellent for what traders need them for. They are almost always worth $1 and can very quickly be used and moved. They only need to worry proportional to the likelihood that Tether or Circle freezes their tokens or the tokens themselves de-peg. Many of them work to minimize even this risk by holding it in only limited quantities or limited amounts of time.

Dai is censorship-resistant ‘enough’. Circle has not frozen the coins, and USDC has not depegged, and it due to its liquidity and size, it is less exposed to certain de-pegs that Rai would be exposed to. Stablecoins have a bit of a chicken and egg problem in that for them to really be stable in the market place they need enough people using them that there is a regular and liquid exchange in the token. Otherwise, relatively small dollar amounts exchanged risk major dislocations in the market price. Dai’s additional liquidity and adoption, leads to more liquidity and adoption because the adoption and liquidity inherently make it more stable. This is also the fundamental bet of algorithmic-stablecoins like Terra, that they can become broadly demanded and adopted so that they retain their value, despite not necessarily having adequate ‘collateral. This is why Terraform Labs is willing to sustain the unsustainable yield at Anchor, because it helps grow Terra and hopefully will continue to feed that demand and liquidity. That is why Do Kwon encouraged Dani and Sifu to continue using Abracadabra’s degenbox, because it kept driving demand and liquidity for Terra.

Rai does not have any similar mechanisms to help drive demand and liquidity, and due to its design goals their ability to try to incentivize it with any tokens they do have in the treasury, or any ‘ponzi-nomics’ mechanisms. So Reflexer/RAI sits in this awkward area where it is laser focused on the things that should most matter in crypto, but because the things that SHOULD matter are not the things that actually drive most of the liquidity they have ended up outside even the top 500 coins. This is even despite the fact that they had support from top-flight crypto firms like Paradigm and Pantera. Without that support I imagine that the protocol could be even smaller than it is today.

It is possible that in the future there will be crystallizing events that will remind people that the value of crypto is driven by censorship-resistance. However, any version of those events that I can imagine would have devastating consequences for the decentralized finance community as a whole. If for example Circle was pressured by the US Government to freeze USDC used in USDC-PSM for MakerDAO, and Dai were to de-peg as a result it would destabilize almost any protocol that relies on Dai, and that effect compounds as any protocol that depends on a protocol that depends on Dai will also be destabilized.

This is why the closer you get to the ‘base’ in a modular decentralized finance world the more conservatively and carefully it needs to be designed. This has always been my complaint about MakerDAO, that it was not designed as if it was going to serve as the base unit for an entire new financial system. I think Rai/Reflexer does a much better job of trying to design towards that goal, but in doing so they have made it harder to get adopted.

Postscript: As someone who has spent a bunch of time reading Dai contracts and documentation, I deeply appreciate that Reflexer took the time to map Maker’s ‘unique’ names to something intelligible.

If you would like a PDF version of this report you can find it here.