Is Olympus DAO a Ponzi?

One of the most common claims you will hear on Twitter about Olympus DAO or any of its innumerable forks is that it is a Ponzi. As someone with strong opinions on Ponzis, I wanted to take a deep look to try to see if the protocol paying out 'thousands of percent' in 'APY' is a Ponzi or not.

What is Olympus DAO supposed to do?

Olympus DAO issues a token called OHM which is meant to be a ‘decentralized reserve currency’. Olympus is not a stablecoin and is not meant to maintain a specific peg, it is instead meant to have a value of at least ‘the backing’ and can range above that.

How does Olympus DAO work?

How do you get OHM?

You get OHM by ‘bonding’ another asset. So, for example you may choose to purchase a bond with some of your Dai. You are then given your OHM over a brief period, at a discount to the current OHM price. This is meant to incentivize more people to bond assets. It is important to note that the price of OHM can fall below your ‘discount price’ during the time your bond is vesting, and you can still end up losing out on this trade.

Can you exchange OHM for the backing?

Sometimes! There is a functionality that can be deployed when the ‘policy team’ chooses called “Inverse Bonds”. These inverse bonds allow for you to exchange your OHM token, at a slight premium to the current market price in exchange for some of the assets backing OHM, and the OHM you use to purchase the bond is then burnt. These are always finite in quantity and are only available when the policy team chooses, and the OHM price is below the ‘backing value’.

The ‘trick’ with these is that they are priced at a premium to current market OHM prices while still being priced below the proportional share of the backing represented by that OHM, when inverse bonds are priced in this range, they can burn the OHM you use to ‘purchase’ the backing with the bond, and in doing so increase the total backing per OHM.

You are of course incentivized as a seller to use the inverse bond instead of selling into the market, because you can get the premium over the market price.

Several important things to remember about inverse bonds: their quantity is capped, they are released at the behest of the ‘policy team’, they offer a premium over the market price of OHM, they try to increase the backing per OHM by burning the repurchased OHM.

How does staking OHM work?

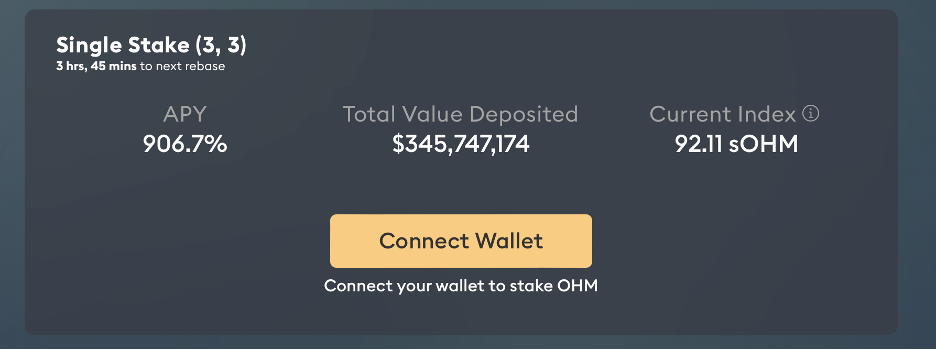

On Friday March 4th, 2022, as I write this you can currently receive an ‘APY’ of over 900% if you stake your OHM. This number has been as higher than 17,000% in the past.

I know many reading the numbers are immediately answering the titular question with a resounding, “YES”, but before we get excited, it’s valuable to understand the oddities of how staking works for OHM.

Namely, the numbers do not mean what you expect them to mean. If you stake $100 worth of OHM you will almost certainly not have $1,000 worth of OHM at the end of the year. What the staking APY represents is how much of the new supply of OHM you capture.

Effectively by staking you help ensure that your relative portion of the market cap does not change. If you have 1% of the OHM supply, and you stake it for a year, you should expect to still have ~1% (likely slightly more because not all OHM is staked) of the total supply of OHM.

It is conceivable that your $100 of staked OHM will end up worth $1,000, but that requires the market cap of OHM to increase by roughly a factor of ten.

What does it mean that OHM rebases?

Three times a day the Olympus DAO protocol issues more OHM which is then primarily distributed to stakers. The supply of OHM is meant to continually increase unless the price of OHM falls to or below 1 DAI at which point no more can be minted, or if price falls below 'liquid backing' then Inverse Bonds may be used to reduce the supply.

Where does the value come from?

I have spoken largely abstractly about the mechanisms in this protocol, but the mechanisms are only interesting insofar as they illuminate how the protocol expects to deliver value to investors.

Bonding, staking, and rebasing

As we have established staking allows you to maintain your same relative portion of the market cap, but that only benefits you if the market cap is increasing.

Olympus DAO tries to deliver this value primarily by selling bonds, where users give up their existing assets in exchange for receiving OHM.

In short: value accrues to current investors when new investors exchange their existing assets for OHM.

"Liquidity"

Often when protocols launch they will have a pool where you can stake your ‘LP’ token (representing the liquidity you deposited into the pair) in a pool and earn more of the governance token.

Olympus DAO has a service called Olympus Pro where they will help other protocols set up their own ‘bonds’ like Olympus DAO has. These bonds allow people to exchange their LP tokens for a discount on the governance token.

The ‘trick’ here that makes this potentially valuable is that it gives the protocol control over their own liquidity in the marketplace, rather than having to continually emit more tokens to try to keep liquidity.

This potentially helps protocols avoid sudden price movements as liquidity is withdrawn and keep slippage low for their token. When a protocol owns their own liquidity, they are also able to earn the fees paid to liquidity providers.

This service benefits Olympus DAO because they collect fees on the bond payout, allowing Olympus DAO to acquire governance tokens for all their partner protocols in Olympus Pro.

Is Olympus DAO a Ponzi?

What is a Ponzi?

A Ponzi scheme is where early investors are paid out by later investors, and investors believe that profits are coming from legitimate activity. The original Ponzi scheme began with a legitimate arbitrage opportunity in international mail reply coupons, however when the initial arbitrage was depleted the scheme continued by paying early investors with the new funds attracted by the seemingly extraordinarily returns.

Is it?

Early Olympus DAO investors only secure more value when more people continue to join the protocol. Their rewards are paid primarily from the fees from the bonds (along with the LP fees), and while new investors continue to want to bond and participate in the protocol, then rewards can continue to be paid out to existing stakers. That certainly sounds like a Ponzi scheme, but an important part of the definition of Ponzi scheme is that investors believe that their rewards are coming from legitimate activities.

Throughout history there have been a few different attempts by people to run ‘Honest Ponzis’ where the goal was to recreate the mechanics of a Ponzi scheme, but under the conditions where all participants are aware that is what going on. Crypto has a pretty long history of these, including previous schemes on Ethereum like FOMO 3D and PowH3D. Morally these certain seem much better than dishonest Ponzi schemes, but beyond that always end when the number of available suckers has been reached.

OHM and Olympus DAO (and its endless forks) certainly have Ponzi-like mechanics, but I think it is possible to argue that they are fully upfront about their mechanics and where the funding is coming from. This initially leads me to want to say that Olympus DAO is an ‘honest’ Ponzi.

However, in the official Olympus DAO documentation (archive) new investors are told that “with loose policy, regardless of scale, Olympus has the potential to act as a wealth creation machine.” Olympus DAO has not discovered perpetual motion. We have already established that returns are paid out by having new assets bonded to the protocol, and seeing as the number of assets and the number of people who can bond assets are both finite we must conclude that it cannot continue that function at any scale.

Therefore, since older investors are paid out from new investor funds and investors are being deceived by the enterprise and the nature of its abilities, it is a Ponzi scheme. Perhaps not a surprising conclusion for a protocol that offered’17,000% APY’. The real question is whether it matters.

Bonus risks for the protocol

Because I’m having so much fun analyzing Olympus DAO, I figured I would discuss several of the ways this could fail that are entirely unrelated to whether it is a Ponzi.

USDC and Dai

OHM depends on Dai at a very base level, with no OHM being able to be minted if the price of OHM falls below 1 Dai. Furthermore, a significant portion of Olympus DAO’s ‘Risk Free Value’ is denominated in Dai.

Dai (as I’ve discussed before) is at risk of a very sudden and painful de-pegging. A very meaningful amount of the collateral is PSM-USDC. This specific vault cannot be liquidated, even if USDC breaks peg, and the vault cannot recognize if Circle were to choose to freeze the value of USDC in MakerDAO making it worthless. Similar risks apply to other custodial assets held by MakerDAO like WBTC and USDP.

If Dai fails it seems clear to me that Olympus DAO is likely to have extraordinary problems.

Frax

Frax is an algorithmic stablecoin that is held in the ‘Risk Free Value’ portion of the Olympus DAO treasury. (You can hear me debate the Frax founder here) Frax is also collateralized by USDC and yeah you see where this is going don’t you?

Terra

Terra is another algorithmic stablecoin (that subscribers read about last week), that is effectively collateralize (or at least supported) by the value of the governance token Luna. Like every algorithmic stablecoin it is attempting to bootstrap belief in a new fiat currency in an adversarial environment. Because of the nature of that task there are a variety of ways that it can fail.

Terra is also a large portion of the ‘Risk Free Value’ portion of the Olympus DAO treasury.

Volatile Treasury Assets

The treasury for Olympus DAO is comprised of a variety of different governance tokens, LP tokens, and stablecoins. Many of these governance tokens are very volatile and highly correlated assets that can very quickly lose very meaningful amounts of value.

Why do these matter?

If the value of the Olympus DAO treasury rapidly falls then it is expected that the market cap of OHM will fall as well. The ‘backing value’ behind OHM is a volatile value effectively representing the protocols that OHM has decided to partner with.

Conclusion

After reading both whitepapers and all the documentation for Olympus DAO (parts of which are out of date and no longer accurate) I do believe that Olympus DAO is a Ponzi scheme. I do not believe the project has any reasonable chance of becoming a ‘decentralized reserve currency’ as the stated goal is. The incentive design of the system seems vastly better at enriching early investors than it does at becoming a ‘decentralized reserve currency’.

Though I also cannot avoid noting many of the similarities to ‘The DAO’. The DAO on Ethereum was a collective investment fund in which individuals were able to buy the governance token for the DAO, and then vote on what investments the DAO would make, potentially allowing them to profit from the increase in value of those profits. Olympus DAO’s mechanisms to try to end up with stakes in other protocol’s governance tokens certainly has some similarities to the goals of the DAO, but with a Ponzi scheme layered on top. OHM tokens are ~almost~ like a share in a hedge fund that has effectively guaranteed that it can continue to deliver “wealth generation” at “any scale”.

However, in a world where CoinDesk will compare this model to the US dollar, and social clubs will declare that “We’re on the ground floor of what could be the beginning of everything” and get coverage in the NY Times, it really seems as though people want models where early investors get rich. I expect that this desire is mostly rooted in a desire to be an enriched early investor, but historically most Ponzi scheme participants find themselves less than enriched.