Is Terra Stable?

TerraUSD (called Terra for the remainder of this post) is a stablecoin pegged to the US Dollar. Since the only thing that matters for a stablecoin is how well it can maintain its peg regardless of the conditions, I will attempt to assess whether or not the design of Terra is such that it can always maintain its peg to the dollar.

Why is Terra worth a dollar?

Terra is worth a dollar because you can exchange it for about a dollar worth of Luna.

What is Luna?

Luna is the token that can be staked to ‘mine’ Terra rewards in the Terra ecosystem. In order to become a validator and oracle in the Terra ecosystem you need to acquire and then stake sufficient Luna.

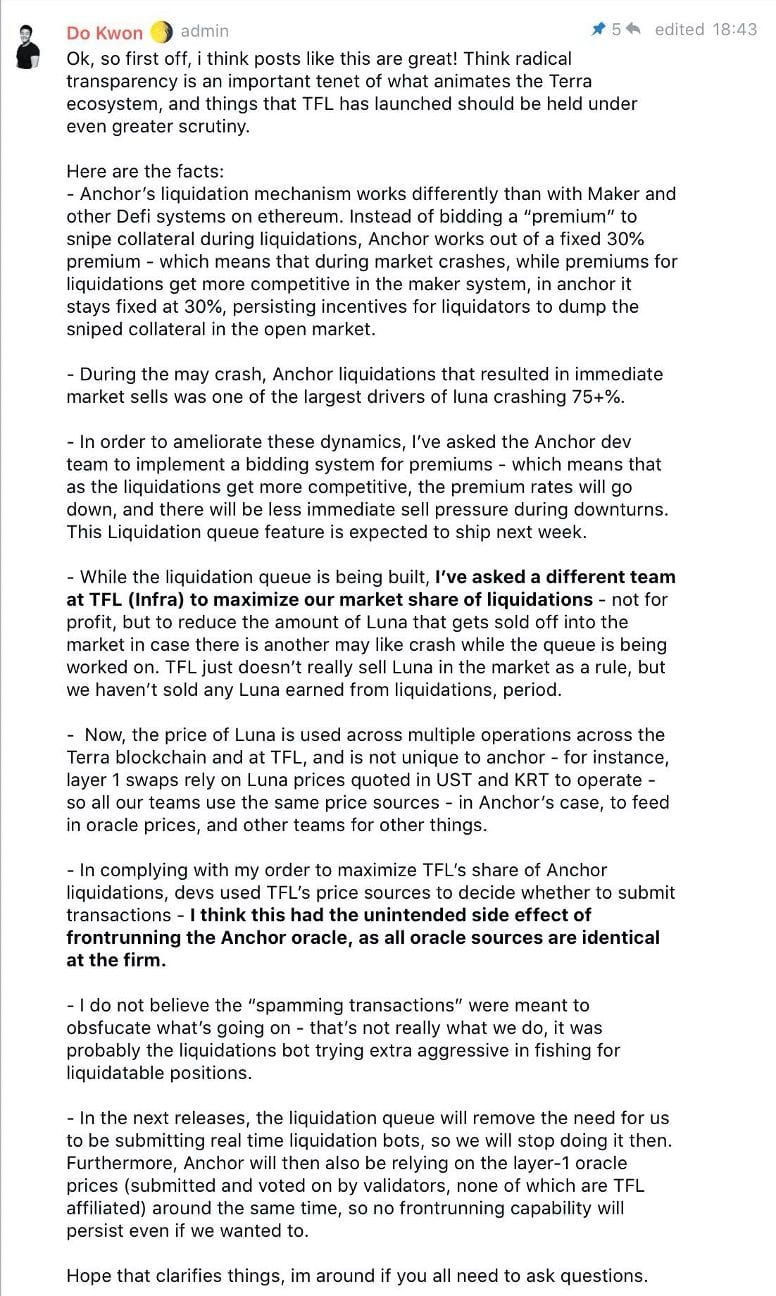

What happens when Terra is below a dollar?

When Terra is below a dollar, the protocol attempts to incentivize users to burn their Terra, receiving one dollar worth of newly minted Luna for each Terra burnt.

What happens when Terra is above a dollar?

When Terra is above a dollar, the protocol attempts to incentivize users to burn their Luna, receiving one Terra for every dollar’s worth of Luna burnt.

What helps keep Luna valuable?

In order to get Terra you must burn Luna, which decreases the amount of Luna available, theoretically increasing the value of Luna. Unfortunately, this only contributes to Luna value when there is demand for more Terra.

Luna is also the asset that is ‘staked’ and thus receives staking rewards, which are meant to come from the gas fees and the fees from swapping. Since you can earn these rewards from staking, there is demand for Luna from those who want to receive those awards. However, both gas fees and swapping are more likely to occur when there is significant new demand. A roughly steady state of circulating Terra with offchain liquidity will have infrequent swaps, and with much of Terra being bridged to other chains, it becomes harder to collect gas fees. Terra eliminated the ‘stability tax’ which used to paid to stakers, in an attempt to make development on Terra easier.

The other thing that makes Luna valuable is that is can be used to vote on governance proposals for the protocol, so if you are exposed to the ecosystem there is some incentive to own Luna so that you can weigh in on issues that affect you.

Why might Terra not be worth a dollar?

As with any algorithmic stablecoin, you are effectively trying to incentivize a cult of belief around the value of your stablecoin, so that it will retain value. All the machinations of algorithmic stablecoins are premised on the continued belief that something has value, in this case that something is Luna (and to a lesser extent Terra). For Frax it is FXS, bitUSD had bitShares before its failure. This fundamental truth is what contributes to the stability problems inherent in algorithmic stablecoins. It requires tremendous belief to complete the alchemical task of turning lead to gold. So the things that represent the largest threat to Terra stability, are things that threaten the belief.

Fundamentally, the value of Terra is protected by the value of Luna, in the same way that MKR backstops the value of Dai by being the asset that is diluted to preserve the peg. So in many respects the value of circulating Terra is derived from the value of Luna, and if the value of circulating Luna falls below the value of circulating Terra then the system becomes much more likely to collapse, as is there insufficient demand for the effective ‘collateral’ of Terra.

A complicating factor is of course that the vast majority of cryptocurrencies are incredibly volatile, and Luna itself has not escaped these spikes and knives. Luna increased in value 13,500% in 2021 and has decreased in value 45% so far in 2022.