How does MakerDAO handle 'Real World Assets'?

What is MakerDAO?

MakerDAO is the protocol that distributes the Dai stablecoin. It is a ‘debt’ based stablecoin, where users are essentially extended a loan denominated in Dai that is collateralized with another asset. I have written about it previously if you want a more technical discussion of how it functions. However, the brief explanation is that users deposit assets into vaults, and when these assets are not stablecoins the loan needs to be overcollateralized. They are then extended the Dai loan. If the value of the collateral starts to drop, then you must either reduce the size of your outstanding loan (by paying back Dai) or the protocol will attempt to liquidate your collateral. If the protocol is unable to liquidate the collateral then it will use the surplus accumulated from fees paid by those getting loans to try to cover the difference and keep the protocol collateralized. If there is inadequate buffer (which would require many liquidations) then the protocol attempts to mint and sell more of its governance token into the market to keep Dai adequately collateralized.

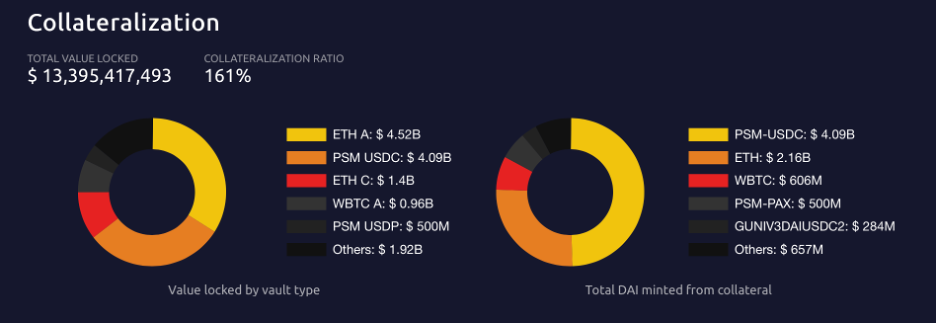

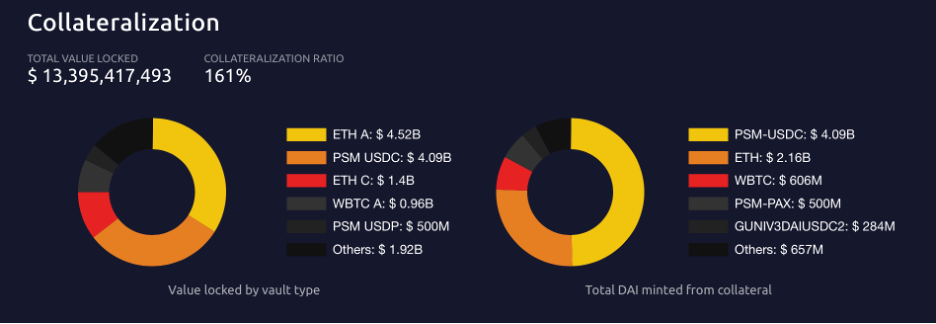

The complicating factor currently for MakerDAO is that much of their collateral is custodial. Which means that the custodian can often freeze, blacklist, or otherwise instantaneously devalue the tokens. This means that MakerDAO’s continued existence as a functional protocol currently is thanks to the continued cooperation of other entities.

You may remember that this was one of the problems that Reflexer/Rai was trying to solve. As I explained in that piece, MakerDAO sacrificed some amount of censorship resistance in order to continue to grow and maintain a tight peg.

Consider the amount of collateral that is currently in USDC (Circle’s stablecoin) and USDP (Paxos’ Stablecoin) and WBTC (wrapped Bitcoin). These being frozen or otherwise devalued would substantially affect Dai. This is especially true since any of these vaults associated with the ‘Peg Stability Module’ or PSM cannot be liquidated, as they are assumed to always be worth $1 to enable Dai to be easily swapped for another stable asset (and vice versa).

How do 'Real World Assets' fit in?

Over the last several years MakerDAO has begun to extend loans for assets that exist in the real world.

Currently these include extending loans for home flipping, real estate, SaaS companies, Supply Chain Finance loans extended to Snakebyte Asia, and tokenized freight shipping invoices.

They intend to in the very near future expand to a variety of other assets. For one, they intend to begin reducing PSM vaults in favor of investing in short term bonds, and there have been other proposals to begin investing in US treasuries (though those have not passed).

What is the implication?

MakerDAO is moving further away from their crypto-native foundation and are increasingly becoming a web of corporate entities, trusts, and trustees, tied deeply to the real world and real world governance, in a manner more reminiscent of a money market fund.

What are the problems?

Cryptocurrency is interesting to me, because it does seem somewhat uniquely well-suited to solving challenging problems of censorship-resistance and resiliency. The reason I was originally interested in MakerDAO four years ago is because they seemed to be using that ethos to try to build a decentralized and censorship-resistant stablecoin. Even at the time I thought there were flaws, but there was a certain nobility in pursuing that goal.

When I look at MakerDAO now I see a money market fund. One managed in a somewhat decentralized manner, but also one that seems to have many of the same risks as the money market funds in 2008, but with no one to step in and bail them out.

As I mentioned in my Reflexer piece, Dai is an extraordinarily important part of the entire DeFi ecosystem, with countless protocols depending on it either directly or indirectly, and as such Dai failure states can quickly become ecosystem failure states.

Oracle Problems

MakerDAO depends on Oracles, or applications which write the value of certain assets to the blockchain, to determine whether or not vaults need to be liquidated. This becomes vastly more complicated when the assets have an unclear valuation at any single point in time, and there are a variety of situations in which MakerDAO may struggle to determine the instantaneous value of any of these assets. This becomes increasingly important if a variety of assets move together, for example due to a change in liquidity.

Liquidation Problems

It can be difficult, slow, or otherwise challenging to offload certain assets, and this problem is compounded when the assets valuation is rapidly dropping. Having these real world assets as an integral part of MakerDAO means that governance token holders need to be regularly and frequently assessing the changing risk of these niche financial products in order to ensure that Dai is appropriately collateralized, and when they do finally choose to liquidate they need to still rely on other intermediaries to make the liquidation possible.

Censorship Problems

Depending on intermediaries and assets tied to the real world means that the value is tied to real world issues, including lawsuits, seizures, business issues, fraud, and more. Perhaps most strikingly it gives targets to any state with an interest in damaging Dai (and every protocol that directly or indirectly depends on Dai). This fundamentally reduces the censorship-resistance of Dai and ensures that MakerDAO needs to continue to maintain a variety of entities.

The "Good" Interpretation

It is relatively easy to understand why MakerDAO wants to do this. They realize that they need to continue to grow, which means they need to continue to find new sources of collateral, and despite the best efforts of A16Z certain assets are still deeply tied to the real world. They hope that they can eventually diversify across enough of these assets that they are not tied to any one of them too strongly. This way if a government chooses to target one, or one happens to fail, the protocol as a whole is still fine. Many of these assets are yield-earning and could potentially materially approve the ability for Dai to grow, or to protect itself from difficulties in liquidation

They may no longer be the ‘ideal’ censorship resistant stablecoin, but they hope to become a decentralized money market fund, allowing governance token holders to vote and determine the risk they feel is appropriate, and potentially paying back some of the yield earned to Dai holders.

Conclusion

Money market funds at their best are an underappreciated systemic risk to the financial system, creating an asset that everyone believes to be ‘money’ and worth a certain amount, until Lehman Brothers can no longer roll their commercial paper. Then the liquidity vanishes and systems start to deteriorate. The last time this happened in the United States there were bailouts and liquidity backstops provided by the government and the central bank, and MakerDAO has no mechanism like that.

I find MakerDAO increasingly less interesting as they continue to move further and further away from being a censorship-resistant stablecoin and towards becoming a decentralized money market fund. I fear that if they are successful, they will devastate the decentralized finance ecosystem.

You can find a PDF copy of this report here.